Designed for complex operations, the virtual data room solutions allow users to work effectively throughout the process of M&A. Within this intricate path, ensuring the exchange of significant confidential information is vital and demands secure safeguarding.

Yet, document security is not a company’s sole challenge in mergers and acquisitions transactions. Business owners allocate significant resources, both in terms of time and money, to these endeavors. This allocation diverts attention from other critical tasks, hindering a focused approach to the company’s overall development.

VDRs make it possible to solve all these problems. They protect information, allow you to store it in a structured way, and easily control all stages of the merger and acquisition transaction.

Advantages of a virtual data room in M&A

There are many interests in using a virtual data room for merger and acquisition, and here are some of them.

High level of protection

Confidential documents are exchanged between the parties to the transaction during the takeover or merger process. To prevent them from falling into the hands of competitors, VDR suppliers provide the maximum level of protection:

- encryption of data during download, use and storage;

- centralized connection to the room;

- at least two-factor user authentication;

- control of access to files;

- remote removal of access to documents;

- possibility to prohibit modifying, printing and downloading files from the VDR.

In addition, a secure data room allows you to apply dynamic watermarks to documents to avoid leaking confidential information. You can also see which employees and partners have used which files and what changes they have made daily.

Convenient storage of numerous documents

In addition to document security, the VDR makes it easy to store large amounts of information. All files are structured, making finding the desired file easier. In addition, most suppliers offer an automatic indexing function. This means that the documents will be stored in the order in which they were uploaded to the room.

You can not only store files in any format in a VDR. You can download both financial documents for a company audit and a video presentation of your company for the first stages of negotiations.

Convenience and ease of merger and acquisition operations

The complex merger and acquisition process, which requires the exchange of a large amount of data, will be simple and practical with the help of the VDR. Here at https://dataroom-providers.org/blog/the-a-z-guide-to-ma-pipeline-management/ you can get step-by-step guidance on managing the M&A process with VDRs help.

According to Ronald Hernandez (Founder of dataroom-providers.org), from the beginning, each party to the transaction has access 24 hours a day to the necessary information, and it is no longer required to meet in person to exchange documents. In addition, neither party needs to spend time requesting the necessary files.

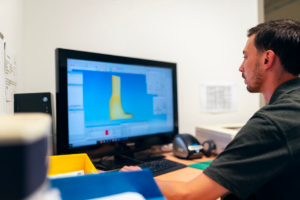

Secure virtual data on a PCAll simplifies the merger and acquisition process, makes it more efficient, and saves time for all parties concerned.

Simplification of due diligence checks

The virtual data room has all the necessary tools to conduct business research and audits. They not only simplify the due diligence process but also make it transparent. This can only inspire confidence in potential partners and increase the probability of agreeing.

In addition, VDRs have special online chats and question-and-answer forms that can help you clarify all the nuances and solve all your questions on the spot. In addition, most suppliers offer 24-hour technical support, facilitating quick and convenient verifications.

The fact that you save money

With the help of a secure data room, companies can save a lot of money. First, paying experts to travel to examine the documents is no longer necessary.

Secondly, spending money on constant flights for meetings with potential partners is no longer necessary. All this can now be done online from any city.

Third, renting a physical room with adequate security will cost several times more than a VDR. In addition, the duration of the lease of a virtual room will be much shorter because online agreements are signed much faster.

Step-by-step preparation for connecting and obtaining a virtual data space

It is essential to analyze the identification of all the necessary documents, their organization by categories and themes, as well as the definition of confidential files. It is worth creating your virtual data room. Consider the following questions:

- What documents are required during the due diligence procedure?

- How much space does storing confidential documents in the M&A virtual data room take?

- How many users work in the data room?

By answering these questions, you will guide yourself for further work with the required data rooms. Decompose processes into smaller, manageable tasks and create checklists. This makes downloading files to your virtual data space easier and reduces the risk of forgetting something important when managing folders.

Conclusion

Virtual data room business helps companies save time and money during mergers and acquisitions and in other situations. With a VDR, you can simplify the process and make it convenient for both parties. You will have all the necessary tools to work comfortably in a team in one place. In addition, thanks to virtual rooms, all your documents will be protected against cyber fraud and leaks.